Fractional CFO Insights 2025

CFOs are not anti-AI, they are pro-trust

Fractional CFOs are a key stakeholder in driving value across millions of small businesses. So, over the past 3 months, my partner Gana and I spoke to 30 fractional CFOs to understand the challenges they face in helping mainstreet businesses manage their finances and the role of AI in bridging this gap. below is a comprehensive report on our findings.

Executive Summary

Fractional CFOs work on the frontlines of small and mid-sized main street businesses. They walk into companies that often have no structured processes, inherit messy data, and somehow need to deliver clarity and forward-looking guidance. To understand how AI might change this work, we spoke with 30 fractional CFOs across different industries and geographies within the US.

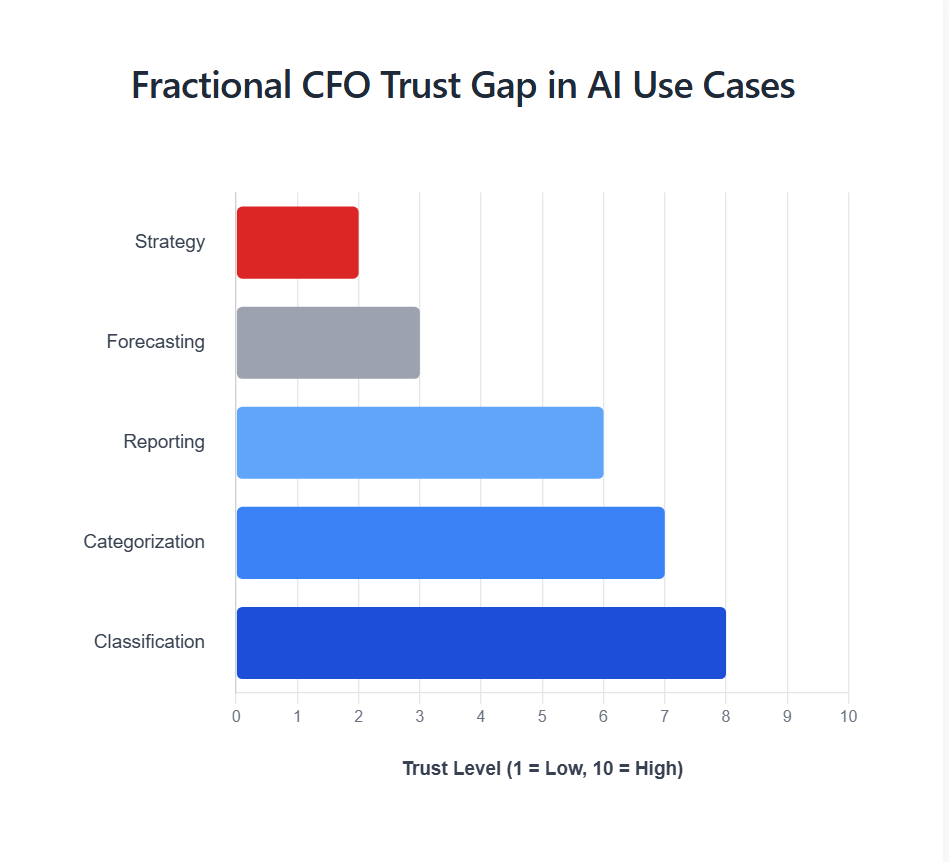

What we found was clear: trust, not technology, is what's holding them back. These CFOs are fine with AI handling routine bookkeeping and categorizing transactions, but they hesitate when it comes to forecasting or making strategic decisions. Excel is still their go-to tool for anything mission-critical, even though AI tools are becoming more available.

Five things stood out from these conversations:

1. Messy data is everywhere. CFOs spend way too much time just cleaning and organizing information before they can even start analyzing it.

2. Reporting eats up their time. Many spend up to 10 hours per week per client just preparing board presentations and variance reports.

3. Forecasting tools are lacking. CFOs told us that 13-week cash flow projections and scenario planning are critical gaps they need filled despite emerging tools In the market.

4. There's a real trust issue with AI. Classification tasks feel safe to them, but forecasting feels too risky.

5. QuickBooks runs everything. Nearly every small business uses it, so any AI tool has to work seamlessly with it.

The takeaway from these conversations was resounding; AI tools for CFOs need to start by earning trust. Tools that deliver immediate, accurate wins in data cleanup, transaction categorization, and variance analysis will get adopted. Many CFOs felt that the big prize for AI is in strategic insights and decision support that drives real outcomes for small businesses.

The role of the Chief Financial Officer is changing and nowhere is this more visible than in the world of fractional CFOs. Increasingly, small and mid-sized businesses are turning to part-time financial leaders to bring order to their books, accelerate reporting, and provide the kind of forward-looking insight once reserved for large enterprises.

Introduction

Fractional CFOs step into businesses where financial systems are often lacking. Accounting data lives across QuickBooks, spreadsheets, filing cabinets, shoeboxes of receipts, paper trail and bank portals. Documentation is incomplete, controls are inconsistent, and reporting is largely reactive. Before they can advise on growth or strategy, CFOs spend countless hours cleaning data, reconciling accounts, and assembling reports.

At the same time, demand for fractional CFO services is growing. industry data shows U.S. demand for fractional CFOs has more than doubled year-over-year. As businesses scale, they need financial clarity but cannot afford full-time executives. This creates both opportunity and pressure for fractional CFOs who are expected to do more with less, often supporting 7 to 15 clients at a time, with small teams or alone. The result is a constant trade-off between deep strategic work and manual, controller-level tasks.

Against this backdrop, AI has emerged as a potential lever for transformation. Vendors promise automation of bookkeeping, instant variance explanations, and predictive forecasting. Yet despite enthusiasm, adoption is uneven. CFOs told us they are intrigued but cautious.

This report explores these realities in depth. Drawing from interviews with fractional CFOs across industries, we identify the most pressing challenges, analyze where AI can credibly help today, and outline what must happen before CFOs trust AI with higher-order work.

Methodology

This report is based on in-depth interviews with 30 fractional CFOs across industries and geographies. Conversations were semi-structured. Notes and transcripts were coded for recurring themes, which were then synthesized into insights.

While the sample is not statistically representative, the findings highlight clear, recurring patterns in how Fractional CFOs view their challenges and the role of AI.

The State of the Fractional CFO Today

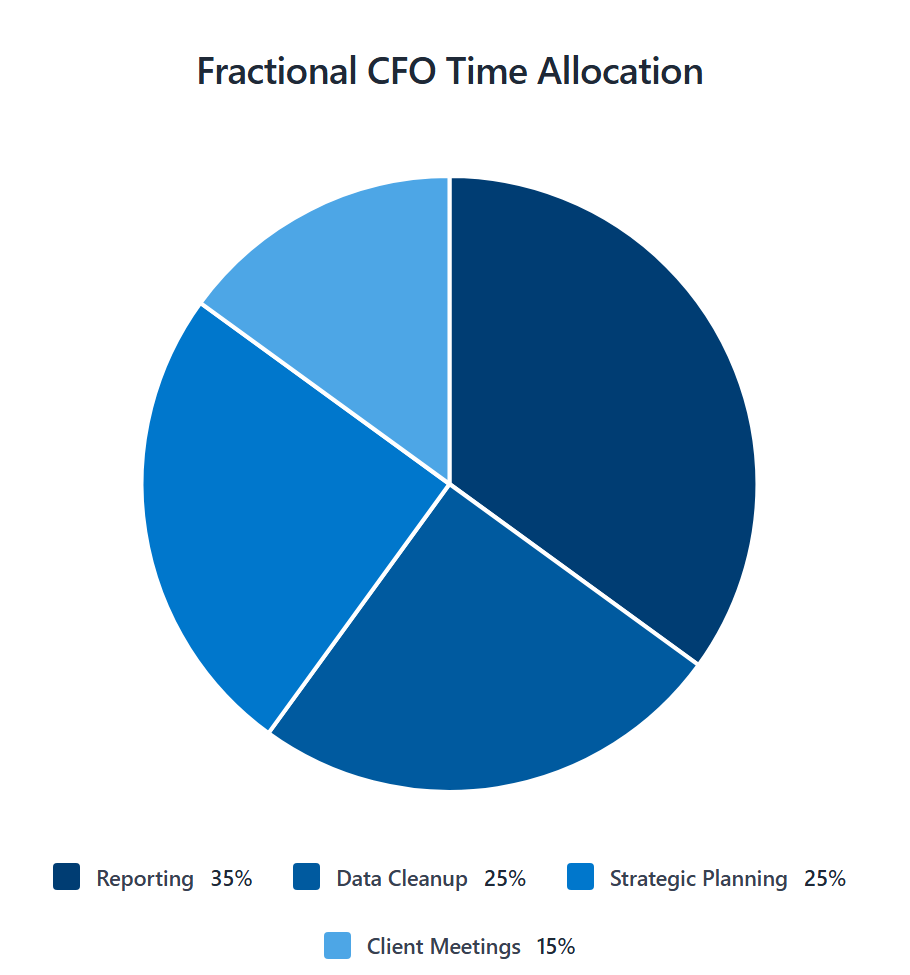

Fractional CFOs occupy a unique space in business finance. They are asked to deliver the strategic insight of a full-time CFO but with the operational burdens of a controller. The result is a constant tension between where they feel they add the most value and where they spend most of their time.

From our interviews, CFOs reported that the majority of their week is consumed by a combination reporting and cleanup work, leaving limited room for strategic guidance. In practice, close to two-thirds of their time is spent compiling reports, cleaning data, or reconciling accounts, tasks that are essential, but far from the forward-looking role CFOs enjoy and most businesses expect. Strategic planning and direct client interaction make up a much smaller share of their workload.

“I spend 8–10 hours per client per week just preparing reports.” — Fractional CFO, Services Sector

“I can’t manage more than 15 clients — impossible right now.” — Fractional CFO, SaaS

This misalignment explains much of the frustration we heard. Businesses hire fractional CFOs for strategic clarity, yet they themselves are constrained by manual work. As one interviewee put it, “Half of us are controllers, half are FP&A guys. We call them all CFOs, but they’re not.”

The Key Challenges Fractional CFOs Face

Despite working across different industries, fractional CFOs described remarkably similar challenges. The most consistent theme was the messiness of client data. Engagements often begin with months of unreconciled accounts, duplicate entries, or literal boxes of receipts. As one CFO put it, “Every client starts with a shoebox of receipts.” Another added, “It’s not access to data, it’s the quality that’s suspect.” Before any meaningful analysis can happen, time is consumed by cleanup.

That leads directly to the second burden, reporting. Nearly every fractional CFO said they spend considerable amount of time producing financial statements, board packs, and variance analyses and other types of reports. This workload caps their client capacity and keeps them tied to manual work, even as businesses expect more strategic guidance.

The third challenge is forecasting. While executives want forward-looking insight, most fractional CFOs rely on Excel models for forecasting and scenario planning. While this is great at producing accurate numbers, it is not as good at identifying root causes of variances or recommendations for corrective action. They know the limitations, but see no credible alternative.

Finally, all of this is underpinned by the trust gap around AI. CFOs expressed optimism about automation for categorization and reconciliation but were more cautious about AI’s application in forecasting and strategy. For most CFOs we spoke to, accuracy, and control are non-negotiable. “I don’t trust AI to forecast for me yet,” one CFO told us.

Where AI Fits (and Doesn’t Yet)

When asked about AI, fractional CFOs drew a clear line between the tasks they trust it for today and the ones they are not ready to delegate. On the trusted side, most pointed to routine work such as categorization, transaction coding, and variance analysis. These tasks are repetitive, rules-based, and low-stakes if corrected. As one CFO explained, “AI is great for classification - the stuff my bookkeepers spend hours on.”

CFOs were more cautious about delegating forecasting and strategic guidance to AI. CFOs repeatedly voiced hesitation to rely on AI for forward-looking insight, citing accuracy as a non-negotiable barrier. “I don’t trust AI to forecast for me yet,” one CFO admitted. Another added, “If it just tells me variance, that’s nice but I need to know it’s right.”

This divide underscores the CFO AI Trust Gap. Automation is welcomed when it saves time on bookkeeping and reporting, but adoption stalls when tools claim to replace strategic judgment. Until accuracy is proven, Excel will remain the CFO’s forecasting tool of choice.

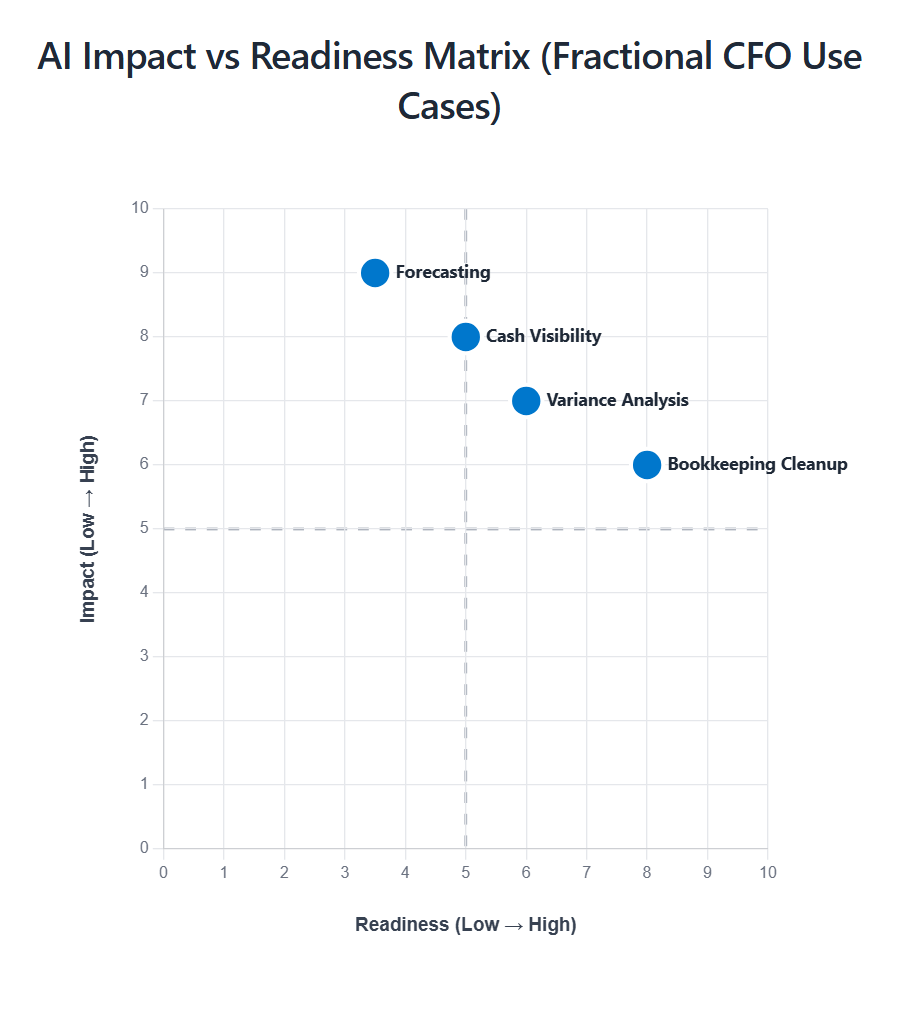

Quick Wins vs Strategic Bets

When fractional CFOs talked about where AI could help them today, they consistently pointed to quick wins such as categorization, AR/AP monitoring, and variance analysis. These are tasks that consume hours of manual work but follow predictable rules. “AI is great for classification, the stuff my bookkeepers spend hours on,” one CFO told us. Automating this layer doesn’t just save time, it builds confidence by showing immediate, tangible value.

But the strategic bets are where fractional CFOs’ interest and skepticism both converge. Every CFO acknowledged the need for AI to help with strategic insights, forecasting and decision support. However, accuracy remains a concern that prevents CFOs from adopting these tools widely.

Vendors who succeed will be those that start with credibility at the base layer and earn trust with high stakes tasks.

Implications: The CFO AI Playbook

The conversations revealed both the promise and the limits of AI in finance today. Fractional CFOs are not resistant to technology; they are resistant to tools that promise more than they can deliver. The path forward is not about replacing CFOs but about augmenting them, starting where the pain is most acute and trust can be earned.

For fractional CFOs, three practical steps emerged:

1. Start with cleanup wins. Solve the messy data problem and automate transaction categorization, reconciliations, and variance analysis which frees hours each week and builds confidence in the underlying data.

2. Automate reporting. AI that can generate reports and board-ready narratives, cutting reporting prep time dramatically.

3. Pilot forecasting carefully. Use AI for cash flow forecast scenarios and sensitivity analysis, but always with human oversight. Treat it as co-pilot.

For vendors building AI tools, the implications are just as clear:

Prove accuracy first. Trust is the barrier. CFOs are not anti-AI, they are pro-trust

Reduce time-to-value. Provide quick tangible wins that save hours and capture adoption.

Integrate deeply with QuickBooks. It is the backbone of SMB finance; seamless integration is non-negotiable.

Earn your way to strategy. Build credibility in cleanup and reporting before claiming forecasting authority.

The playbook is simple; start small, prove value and build trust.

Conclusion

Fractional CFOs are being asked to do more than ever. They step into messy financial systems, spend countless hours on cleanup and reporting, and are still expected to provide forward-looking strategic advice. Their challenge is not a lack of tools, but a lack of time and trust.

AI offers a way forward, but only if it meets fractional CFOs where they are. Automating cleanup, categorization, and reporting can free capacity immediately.

Delivering accurate and explainable outputs builds confidence. Only then can AI credibly move into forecasting and strategic guidance.

The message from fractional CFOs is clear, they are not anti-AI, they are pro-trust and cautious about hype. Tools that deliver immediate, verifiable wins will be adopted. Tools that over promise will be ignored. AI can help CFOs move from being trapped in manual cleanup drudgery to delivering the strategic insight that businesses truly need.

We strongly believe fractional CFOs will continue to be a key partner in unlocking value in main street businesses and are confident AI will be a key tool they use to achieve this.