Superhuman Business Owner

What story does your data tell you

My wife's favorite crime drama is "Bones," and she particularly loves the lead character, Dr. Temperance Brennan. Like many fans, she admires Dr. Brennan not just for her characteristic blunt comic honesty, but for her brilliant ability to piece together evidence to uncover the story behind a crime. I've watched enough episodes to see how Brennan examines a fractured skull fragment, identifies unique tool marks, and connects it to a specific gardening tool — suddenly transforming scattered bones into a coherent narrative about the victim's final moments.

What business owners can learn from Dr. Brennan are the core principles of translating data into a great story that uncovers the right insights to drive action. Those principles are asking the right questions, having the full context (or close to it), and using the right techniques to analyze what's in front of you.

However, sometimes running a small business or walking into a newly acquired operation feels exactly like stepping onto a crime scene where evidence has been scattered everywhere, with no one around to help you make sense of it. You know something isn't right with the business, but you're overwhelmed just trying to figure out where to start looking for answers.

Stay Curious My Friends

"The only thing more dangerous than ignorance is arrogance" – Albert Einstein

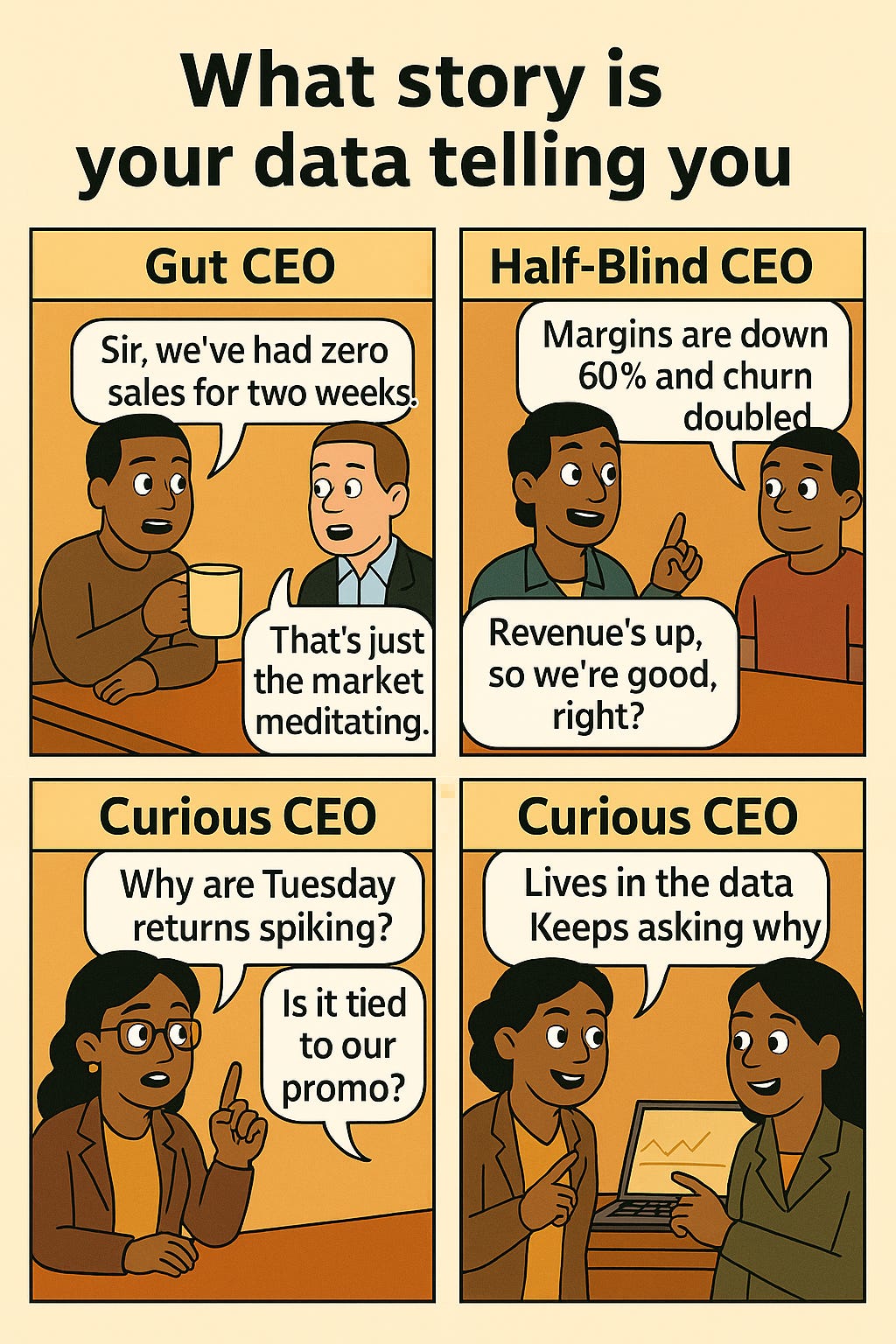

This couldn't be truer when it comes to understanding your business's story through data. In my experience, business owners tend to approach their data in three distinct ways. The most successful are the genuinely curious—those who constantly probe beneath surface numbers, challenging assumptions and seeking deeper understanding. Then there are those who operate with incomplete information—not through any fault of character, but because they don't know which questions to ask or assume everything is fine until it's too late. Finally, there are those who rely too heavily on gut feeling—confidently dismissing warning signals and remaining resistant to what the numbers are telling them. While confidence is valuable, the second and third approaches can leave critical business insights undiscovered.

I learned this lesson firsthand during a period of hyperinflation in Africa running Garage Mobility – a B2B autopart marketplace. When facing steep quarterly price hikes from suppliers and performance pressure across all our cities, we had to make the difficult decision to drastically narrow our product catalog from dozens of brands to just half a dozen. To make these decisions intelligently, I couldn't just go with my gut or what had worked before. Instead, I stayed ruthlessly curious, asking pointed questions about our data: Which brands delivered consistent margins across regions? What products showed the least price elasticity, giving us room to increase prices? Which SKUs had the most vendors carrying them, reducing supply risk? Were locally made products outperforming imported ones during supply chain disruptions? How did seasonal patterns affect each product's profitability over time?

Today, AI can be a game-changer even if you're not naturally inclined toward this kind of curiosity. Instead of staring blankly at your P&L and heaps of operational data in excel to understand where to start, you could prompt your favorite AI chat bot with: "Based on my current cash balance of $125K, monthly revenue of $250K, and expenses of $175K, what five critical questions should I ask about my cash flow situation?" The AI might suggest questions about accounts receivable aging, collection timelines for outstanding invoices, which vendor payments could be strategically delayed, upcoming payroll obligations, or whether there's adequate cash runway for seasonal fluctuations—practical questions that reveal the gap between your healthy revenue numbers and the actual cash position of your business.

Translating data into story

But asking the right questions is only part of the equation. Even with complete data visibility and well-formulated questions, the final critical skill is interpreting what you find. This is where technique separates amateurs from the Dr. Brennans of the business world.

What made Dr. Brennan's team at the Jeffersonian so exceptional wasn't just access to evidence or knowing which questions to ask—it was their mastery of technique. Two forensic teams could examine the same bones, ask similar questions, yet reach entirely different conclusions. The differentiator? How they connected seemingly unrelated evidence points into a coherent, actionable story.

This mirrors my journey at Garage Mobility. I've always been naturally curious, constantly probing our operations with questions. But two critical gaps held us back initially. First, our business data resembled a crime scene with evidence scattered across departments, spreadsheets, and systems. We addressed this by creating a unified data layer that gave us the visibility we covered in our last article. But the game-changing decision was hiring a brilliant young ML scientist—someone who brought the right techniques to make sense of our mountain of data.

So, when hyperinflation hit and quarterly price hikes from suppliers became the norm, this foundation of visibility plus technique allowed us to construct a story that drove immediate action. We built a comprehensive understanding of our cash conversion cycles across different product lines, which revealed unexpected opportunities. The data told us which products we could stock longer in anticipation of price hikes—effectively creating margin through arbitrage while managing our working capital constraints. We identified which SKUs had price elasticity headroom, allowing us to pass some inflation costs to customers without losing volume. Most importantly, we could see which products were steadily becoming unprofitable due to supply chain dynamics, prompting our strategic decision to slash our catalog from dozens of brands to just half a dozen high-performers.

This creates an enormous opportunity for innovators to build full-stack AI solutions specifically for small business operations. Tools that can understand the complete context of a business—connecting financial results with operational realities—and help owners translate their scattered data points into coherent stories that drive specific actions. The Main Street businesses that can access these capabilities won't just survive; they'll thrive by making decisions with the same data sophistication that was once exclusive to enterprises with dedicated analytics teams. In the following we will revisit how you can use the actionable insights from your data story to drive results.

THIS WEEK ON MAINSTREET

📰Mainstreet Minute:

Visa unveiled the new era of commerce this week with AI agents that could use your credit card to perform tasks such as shopping on your behalf. While it is still unclear how long this will take to gain ground, it is clear Visa clearly believes the future of shopping is agentic and personalized. This presents a new paradigm and challenge for small businesses who will need to think about ensuring their offerings are also discoverable and compatible with AI-driven shopping.

📌Quick Win Tip:

Clipdrop is the fastest way to create stunning visuals—without mastering complex design software. Powered by AI, it offers tools like background removal, object cleanup, image upscaling, and generative fill to transform your photos effortlessly. Whether you're enhancing product images or crafting social media content, Clipdrop simplifies the process. Let Clipdrop handle the heavy lifting for your content creation so you can focus on your creative vision. Get a quick win this week by trying out Clipdrop's AI-powered editing tools.